Payroll Summary Report Excel Template

Original price was: 100.00৳ .29.00৳ Current price is: 29.00৳ .

Product Description:

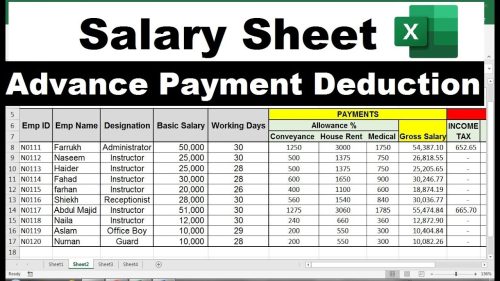

Managing payroll has never been easier with the Payroll Summary Report Excel Template. This template is designed to streamline payroll processing for HR professionals, payroll teams, and business owners by automating calculations and ensuring accurate payroll reports. It helps you track employee wages, deductions, taxes, and net pay with ease, eliminating the need for manual calculations and reducing errors.

With pre-built formulas and customizable fields, the Payroll Summary Report Excel Template provides a comprehensive view of payroll expenses for each pay period. Generate detailed reports that give insight into gross pay, taxes, overtime, and other payroll elements, helping you manage finances efficiently while ensuring compliance with labor laws and tax regulations.

Payroll Summary Report Excel Template Key Features:

- Automated Payroll Calculations: Pre-configured formulas automatically calculate gross pay, deductions, taxes, and net pay, ensuring accurate payroll processing.

- Comprehensive Payroll Overview: Track employee wages, overtime, bonuses, taxes, and deductions all in one template for a clear view of payroll expenses.

- Customizable Fields: Adapt the template to fit your organization’s payroll structure, including tax rates, employee information, and deduction categories.

- Tax & Deduction Management: Record and calculate federal, state, and local taxes as well as other deductions such as retirement contributions, insurance, and benefits.

- Monthly & Yearly Payroll Reports: Generate detailed payroll reports for monthly and yearly periods to track total payroll costs, tax withholdings, and net earnings.

- Overtime & Bonus Tracking: Include overtime hours and bonus payments in your payroll summary to ensure accurate payment and reporting.

- Export & Print: Easily export the payroll reports or print them for HR, management, or financial reporting purposes.

Why Use This Payroll Summary Report Excel Template?

- Accurate Payroll Processing: Eliminate errors and save time by using automated payroll calculations that ensure accurate employee payments.

- Financial Overview: Get a clear picture of payroll expenses, including gross pay, taxes, and deductions, to better manage your budget and financial reporting.

- Simplify Tax Management: Automatically calculate tax withholdings, ensuring compliance with tax regulations and reducing manual efforts.

- Optimize Payroll Management: Track overtime, bonuses, and deductions in a simple and efficient way, making payroll processing smoother.

- Maintain Compliance: Ensure that your payroll practices comply with labor laws and tax regulations by accurately tracking deductions, taxes, and employee pay.

Who Can Benefit?

- HR Professionals & Payroll Teams

- Small & Medium Enterprises (SMEs)

- Business Owners & Accountants

- Large Corporations

- Financial & Tax Compliance Teams

File Format:

- File Format: Excel (.xlsx)

- Compatibility: Compatible with Microsoft Excel, Google Sheets, and other popular spreadsheet programs.

How to Use Payroll Summary Report Excel Template:

- Download the Payroll Summary Report Excel Template.

- Input employee details such as wages, hours worked, and deductions.

- Automatically calculate payroll amounts using the built-in formulas for gross pay, taxes, and net pay.

- Generate detailed payroll reports for financial analysis and compliance.

- Export or print reports to share with HR teams, accountants, or management.

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.